国际黄金期货价格波动的影响因素

来源期刊:中国有色金属学报(英文版)2019年第11期

论文作者:王灏 盛虎 张宏伟

文章页码:2447 - 2454

关键词:黄金期货;供需因素;金融因素;投机;结构向量自回归(SVAR)模型

Key words:gold futures; supply and demand factors; financial factors; speculation; structural vector autoregression (SVAR) model

摘 要:从黄金的商品属性和金融属性出发,以国际黄金期货市场为研究对象,从供求因素、金融因素和投机因素3个方面分析国际黄金期货价格波动的影响因素。应用结构向量自回归(SVAR)模型研究影响因素对国际黄金期货价格作用的方向和强度,并用方差分解法(VDA)比较这些因素的贡献度。结果表明,供需因素仍然对国际黄金期货价格波动起基础性作用,而“中国黄金需求”在国际黄金期货市场中的作用被夸大。金融因素和投机因素对国际黄金期货价格波动有显著影响,这一结果反映出黄金的金融属性变得日益重要。政府与投资者应当高度关注黄金期货的金融属性。

Abstract: Based on the commodity property and finance property of gold in the international gold futures market, the influence factors of international gold futures price volatility are analyzed from the perspectives of supply and demand factors, financial factors and speculation factors. The structural vector autoregression (SVAR) model is applied to investigating the direction and strength of the effects of influence factors on the international gold futures prices and the variance decomposition approach (VDA) is used to compare the contributions of these factors. The results show that the supply and demand factors still play a fundamental role in the international gold futures price volatility and the role of “China’s gold demand” is exaggerated. The financial factors and speculation factors have significant impacts on the international gold futures price volatility, which reflects that the financial property of gold becomes increasingly important. Governments and investors should pay close attention to the financial property of gold futures.

Trans. Nonferrous Met. Soc. China 29(2019) 2447-2454

Hao WANG1, Hu SHENG1, Hong-wHH Hei zhang2,3

1. School of Business, Central South University, Changsha 410083, China;

2. School of Mathematics and Statistics, Central South University, Changsha 410083, China;

3. Institute of Metal Resources Strategy, Central South University, Changsha 410083, China

Received 20 March 2019; accepted 21 June 2019

Abstract: Based on the commodity property and finance property of gold in the international gold futures market, the influence factors of international gold futures price volatility are analyzed from the perspectives of supply and demand factors, financial factors and speculation factors. The structural vector autoregression (SVAR) model is applied to investigating the direction and strength of the effects of influence factors on the international gold futures prices and the variance decomposition approach (VDA) is used to compare the contributions of these factors. The results show that the supply and demand factors still play a fundamental role in the international gold futures price volatility and the role of “China’s gold demand” is exaggerated. The financial factors and speculation factors have significant impacts on the international gold futures price volatility, which reflects that the financial property of gold becomes increasingly important. Governments and investors should pay close attention to the financial property of gold futures.

Key words: gold futures; supply and demand factors; financial factors; speculation; structural vector autoregression (SVAR) model

1 Introduction

Gold is a special non-ferrous metal because of its dual properties of commodity and finance. On one hand, gold can meet the demand for jewelers and industrial uses. On the other hand, gold plays an important role in the global financial system, and is noted as a store of wealth, medium of exchange and unit of value. Gold can be the possess features to serve as alternative investment for assets such as stocks, bonds, and metal commodities. During periods of financial market turmoil, gold is a safe haven [1]. Due to the unstable international economic and political environment in recent years, gold prices have fluctuated frequently. And as shown in Fig. 1, the price of international gold futures, which use gold as the underlying asset, has fluctuated drastically. For investors to mitigate risk in gold price volatility and make future investment decisions, it is important to forecast gold futures price volatility. Hence, it is of great importance to research influence factors of international gold futures price volatility.

The literature on the factors affecting fluctuations of gold prices is mainly divided into three categories. The first category studies gold futures price volatility from a supply and demand perspective. For example, BATCHELOR and GULLEY [2] analyzed the relationship between jewellery demand and the price of gold. KANJILAL and GHOSH [3] proved that gold import demand causes an impact on the price of gold in the short-run. Moreover, STREIFEL [4] and OWUSU et al [5] found that China’ s position in the global market and its quest for natural resources drive up prices of primary commodities including gold. The second category is focused on financial factors. With the development of commodity index funds, high-frequency trading strategies and electronic information technology, the trend of financialization in commodity markets has become increasingly apparent in recent years [6-8]. In this context, many scholars have focused on financial factors that affect fluctuations in gold prices, and mainly considered changes in the exchange rate, interest rate shock and oil price linkage. After CAPIE et al [9] proposed that gold is a hedge against the dollar, some scholars [10-12] proved that there is a negative correlation between gold price and US dollar exchange rate through empirical studies. Wang and CHUEH [13], and HASSANI et al [14] certificated that interest rates have a negative influence on the gold prices. ZHU et al [15] and ZHANG et al [16] proved that international oil price plays an important role in gold price variation. The third category considers the speculation factors of gold. BOSCH and PRADKHAN [17], and ALGIERI and LECCADITO [18] found that financial speculation leads volatility in gold markets. ZHU et al [19] and ZHANG et al [20] pointed out that metal prices are easily influenced by speculators. Except for the above three categories, some scholars seek to investigate the influence factors of gold futures price instead of gold spot price. Batten et al [21] modeled the monthly price fluctuations of gold futures and investigated the macroeconomic determinants (business cycle, monetary environment and financial market sentiment) of its fluctuations. LEE and LIN [22] investigated the mechanism of the impact of the US dollar exchange rate on gold futures prices. SouCek [23] analyzed co-movements of equity, oil and gold futures market. ZHU et al [24] indicated that the volatility of metal futures price is mainly determined by the trade behavior of long-term investors. SHI et al [25] investigated the effect of trading volume in volatility of Chinese metal futures market. By using empirical evidence, FANG et al [26] proved that macroeconomic variables have a significant influence on gold futures volatility, especially during and after the global financial crisis. GONG and LIN [27] found that there are many structural breaks in the volatility of the non-ferrous metal futures prices especially during the financial crisis.

Fig. 1 COMEX gold futures prices from August, 2006 to September, 2018

To sum up, the previous literatures were mainly focused on the influence factors affecting gold spot price but rarely studied the influence factors of gold futures price volatility, while gold futures have a strong hedging function and play a significant role in the global economy [26]. Scholars who studied the influence factors of gold futures price mainly considered the influence of the supply and demand of gold, but ignored the financial factors and the speculation factors in the gold futures market. The existing researches on the influence factors of gold futures price are not comprehensive, which brings limitations to predict the volatility of gold futures market. In order to make up for the lack of existing research on gold futures price, we focus on the international gold futures market, and analyze the influence factors of international gold futures price volatility from a more comprehensive perspective. Some possible factors are considered, including supply and demand factors, financial factors and speculation factors. In addition, given the important role of gold futures, it is still deficient of quantitative studies about the influence factors of international gold futures price volatility. The Structural Vector Autoregression (SVAR) model, has advantage in analyzing the dynamic interactions between relevant time sequence variables, and has already been widely used in the area of economic researches [28-30]. Therefore, in this work, SVAR model is applied to analyzing the influence factors of international gold futures price volatility. Compared with the previous literature, the research perspective of this work is more comprehensive, which makes up for the shortage of gold futures price research. In addition, the CBOE volatility index is used to study the speculative factors of gold futures innovatively. The results of this work are valuable for predicting price fluctuations in gold futures price.

2 Methodology

2.1 Data specifications

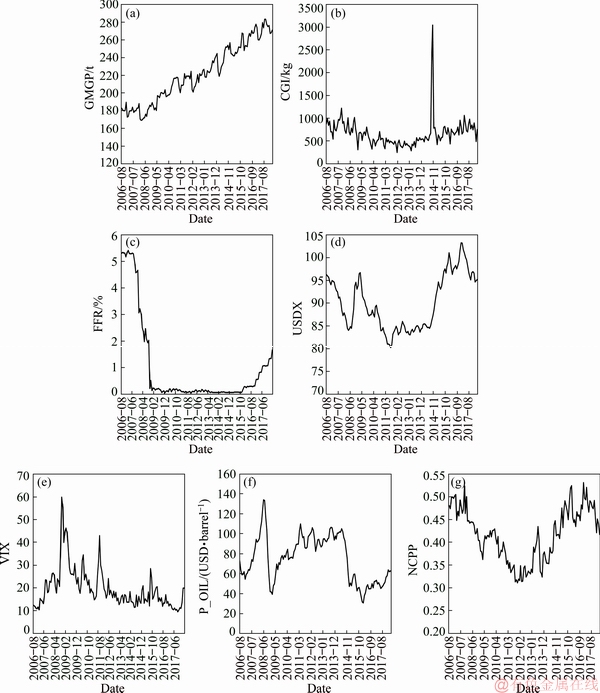

Based on the study of CHEN et al [31], our dataset consists of international gold futures prices (P_AU), global mined gold production (GMGP), China’s gold imports (CGI), federal funds rate (FFR), the broad US Dollar Index (USDX), the CBOE Volatility Index (VIX), crude oil prices (P_OIL), and the percent position held by non-commercial traders (NCPP). Due to limited data, we select the monthly data from August 2006 to March 2018. The gold futures closing prices of the COMEX are selected to represent international gold futures prices. Changes in global gold supply are reflected by the global mined gold production selected based on monthly data provided by the WIND database [32]. Based on Streifel [4], China’s gold imports are selected to represent “China’s demand factor”, and these data are obtained from the average monthly data of gold by China’s customs authorities. Referring to Anzuini et al [33], we use the federal funds rate as a proxy variable for the interest rate.

According to FAN and XU [34], the changes in USD exchange rate are measured by the broad dollar index issued by the Federal Reserve Board, because the broad dollar index measures the changes in the exchange rate of USD against a basket of foreign currencies. Regarding the oil price variable, as it is generally considered to be a good proxy for the global oil price market [34], we use the West Texas Intermediate (WTI) crude oil futures prices for the empirical analysis. YANG et al [35], and GONG and Lin [36] suggested that financial market sentiment has powerful explanatory power to the volatility of futures markets, and Bilgin et al [12] used the CBOE Volatility Index (VIX) for the perception of financial market sentiment. Therefore, the VIX is used as an indicator of the perception of financial market sentiment in this work. Following CHEN et al [31], the percent position held by non-commercial traders (NCPP) of gold futures is used to measure the speculation factor, which is calculated as follows:

(1)

(1)

where NCL, NCS and NCSP denote non-commercial long, short and spread positions, respectively, and TOI denotes total open interest. The data are sourced from the Commodity Futures Trading Commission (CFTC).

Fig. 2 Plots of global mined gold production (a), China’s gold imports (b), federal funds rate (c), broad USDX (d), CBOE VIX (e), crude oil prices (f), and position held by non-commercial traders (g) from August, 2006 to March, 2018

Figure 2 displays the plot of influence factors of international gold futures price volatility and shows preliminary observations during the sample period. To eliminate heteroscedasticity, all the variables have been transformed into logarithmic values in empirical analysis.

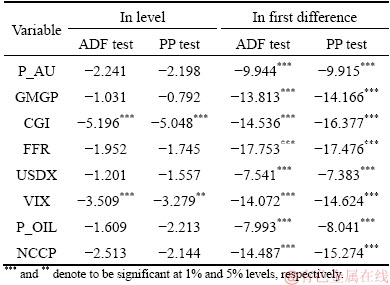

In order to examine the unit root test hypothesis, we perform the Augmented Dicky Fuller (ADF) and the Phillips and Perron (PP) tests. The results of the unit root tests are given in Table 1. The results of the unit root tests show that the CGI is stationary at the 1% significance level, VIX is stationary at the 1% significance level for ADF test and at the 5% significance level for PP test. Other variables are nonstationary but stationary in terms of first differences. To obtain the stationary variables, we select the first differences of the international gold futures prices, global mined gold production, federal funds rate, broad US dollar index, crude oil prices and percent position held by non-commercial traders as the empirical study data.

Table 1 Unit root tests

2.2 SVAR model

To analyze the influence factors of the international gold futures price volatility, a SVAR model is established based on the vector as

(2)

(2)

where xt=(GMGPt, CGIt, FFRt, USDXt, VIXt, P_OILt, NCCPt, P_AUt)T is a vector of eight variables, GMGPt denotes the global mined gold production changes, CGIt denotes the China’s gold imports changes, FFRt denotes the federal funds rate adjustment, USDXt denotes the US Dollar Index changes, VIXt denotes the Volatility Index changes, P_OILt denotes the crude oil prices changes, NCCPt denotes the speculation changes and P_AUt denotes the international gold futures prices changes. α, A0 and Ai are the unknown coefficient vectors and matrixes to be estimated; εt is the vector of serially and mutually uncorrelated structural innovations.

The reduced form of the VAR is represented as

(3)

(3)

where  is the vector of the estimated residuals in the reduced VAR model. The restrictions on

is the vector of the estimated residuals in the reduced VAR model. The restrictions on  are based on LEE and LIN [22].

are based on LEE and LIN [22].

We only assume that the changes of the broad US Dollar Index and VIX are only due to the global macroeconomic environment, and are exogenous to contemporaneous shocks of gold supply, gold demand, speculation and gold futures prices in this model. The errors et of the reduced form can be decomposed into the following components:

(3)

(3)

where the identified structural innovations

denotes the following eight kinds of shocks: shock of global mined gold production changes

denotes the following eight kinds of shocks: shock of global mined gold production changes  , shock of China’s gold imports changes

, shock of China’s gold imports changes  , shock of federal funds rate adjustment

, shock of federal funds rate adjustment  , shock of US Dollar Index changes

, shock of US Dollar Index changes  , shock of Volatility Index changes

, shock of Volatility Index changes  , shock of crude oil prices changes

, shock of crude oil prices changes  , shock of speculation changes

, shock of speculation changes  and shock of international gold futures prices changes

and shock of international gold futures prices changes  .

.

Next, the impulse response function (IRF) of SVAR is employed to measure the influence of one standard structural innovation from these variables on the international gold futures prices.

The variances of the gold futures prices contain basic information that determines the price volatility, and the relative contribution of each factor’s variance reflects the magnitude of the impact on price volatility. Through the variance decomposition approach (VDA) of SVAR, the contribution of each structural impact to the changes of endogenous variables is measured to quantitatively evaluate the relative importance of each factor to international gold futures price volatility.

3 Empirical analysis

3.1 SVAR model impulse response

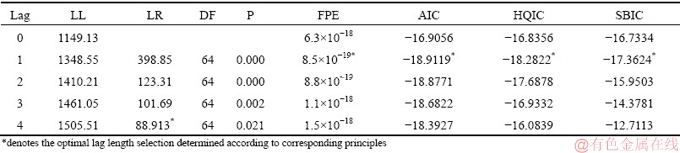

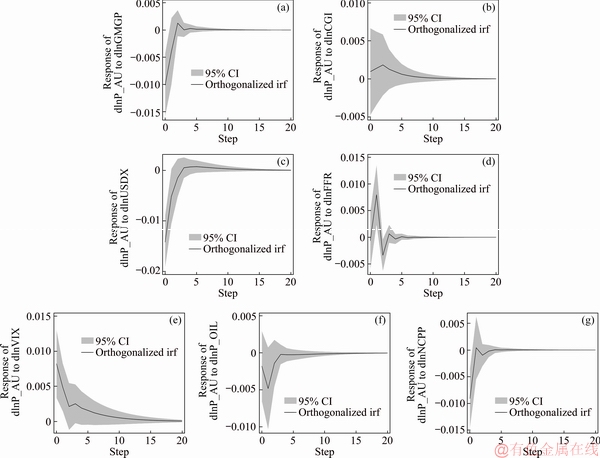

To investigate the direction and strength of the effects of factors above on international gold futures prices, the impulse response of the SVAR model is used to conduct analysis. The lag length of the SVAR model is selected through the Final Prediction Error (FPE), Akaike Information Criterion (AIC), Hannan-Quinn Information Criterion (HQIC) and Schwarz Information Criterion (SBIC). The lag length of 1 is selected according to the result in Table 2. The impulse response functions of the impact of global mined gold production shock, China’s gold imports shock, US Dollar Index shock, federal funds rate shock, Volatility Index shock, crude oil prices shock and speculation shock on the international gold futures prices are plotted in Fig. 3.

Figure 3(a) shows the impulse response result of international gold futures price to one standard deviation of a global mined gold production shock. As shown, gold futures prices respond to the gold supply shock negatively. The response is most significant in the current period but decreases soon, and essentially approaches to zero after five months, which is in line with the law of supply and demand of general commodities. This view is supported by HAN and YIN [37], who found that there was a dynamic long-run equilibrium relationship between economic fundamentals and commodity futures prices, and supply and demand factors still played a role in futures price volatility.

Table 2 Selection of lag length for SVAR model

Fig. 3 Responses of COMEX gold prices to structural one standard deviation shocks of global mined gold production (GMGP) (a), China’s gold imports (CGI) (b), US Dollar Index (USDX) (c), federal funds rate (FFR) (d), CBOE Volatility Index (VIX) (e), crude oil prices (P_OIL) (f), and speculation (NCPP) (g), respectively (Response period is fixed at 20 months)

Figure 3(b) shows the impulse response result of international gold futures price to one standard deviation of a China’s gold imports shock. The China’s gold import shock related to the “Chinese demand factor” has a positive impact on volatility of gold futures prices. However, the statistical significance of the responses is weak because the confidence bands enclose zero. The role of “China’s demand” in the gold futures market may be overestimated.

Figure 3(c) reports the impulse response result of international gold futures price to one standard deviation of a US Dollar Index shock. The US Dollar Index shock has a negative impact on the gold futures prices in the short term, and the response reaches its peak in the current period. The international gold futures prices respond to the changes of US Dollar Index quickly and significantly, because gold is as a hedge against the dollar [9]. The rise of the US Dollar Index means that the dollar appreciates, funds will flow from the gold market into the dollar, and thus the gold futures prices will decrease. Conversely, the decrease of the US Dollar Index means that the dollar depreciates, funds will flow from the dollar into the gold market, and thus the gold futures prices will increase.

Figure 3(d) presents the impulse response result of international gold futures price to one standard deviation of a federal funds rate shock. The shock of federal funds rate is not significant in the first month and then causes a positive response. The rise in federal funds rates will lead to an increase in gold futures prices. This is mainly because gold is a kind of commodity, and the price of gold is inevitably affected by inflation. The increase in the federal funds rate has a positive relationship with the inflation of the US economy, which constitutes a positive correlation between the federal funds rates and the gold futures prices.

Figure 3(e) shows the impulse response result of international gold futures price to one standard deviation of a CBOE Volatility Index shock. The VIX shock has a positive impact on gold futures prices. The VIX is used to reflect the degree of panic among market investors. A higher VIX represents a higher level of panic in the market. In this context, funds tend to drain from high-risk assets and inflow into safe-haven assets such as gold, which pushes up the price of gold futures.

Figure 3(f) reports the impulse response result of international gold futures price to one standard deviation of a crude oil prices shock. The response of gold futures prices is negative in the current period and reaches the bottom in the first month. For the negative impacts of the crude oil prices shock, ZHANG et al [16] attributed it to the profitability of capital. When investors expect that the oil prices are going to rise, they will make more investments in the crude oil market, since the crude oil market and gold market are alternatives for each other. Thus, more capital will flow from the gold market into the crude oil market in order to pursue higher profits, which will cause the gold futures prices to weaken. In addition, investing in crude oil also has the function of diversifying the risk of changes in the US dollar exchange rate [38], which makes it appropriate to invest in crude oil instead of investing in gold.

Figure 3(g) shows the impulse response result of international gold futures price to one standard deviation of a speculation shock. The speculation shock has a negative impact on gold futures prices in a short time. The role of speculative trading on gold futures prices has been one of the key focus areas of research, however, no consensus arises from the existing literature. This result tends to support the hypothesis that speculative trading in futures markets may exacerbate price pressure and amplify price changes to generate volatility in futures prices [39].

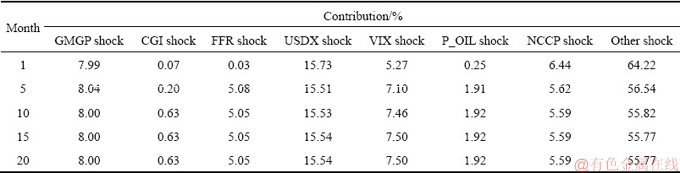

3.2 Variance decomposition

In order to investigate the contributions of the above factors to the international gold futures price volatility, the gold futures price variances are decomposed to eight components using the variance decomposition approach (VDA) and the results are given in Table 3. The federal funds rate shock (0.03%) only contributes to a small fraction of gold futures price volatility in the first month, and this can also explain why the impulse response of gold futures prices to the federal funds rate shock is not significant in the early time. Since the variance decomposition results reach a stable state in Month 20, the decomposition results in Month 20 are finally employed to compare the different factors’ contributions to the international gold futures price volatility. According to the results, the US Dollar Index shock (15.54%) contributes most to the gold futures price volatility in the sample period. The global mined gold production shock’s contribution ranks second among the seven influencing factors. China’s gold imports shock (0.63%) contributes least to the gold futures price volatility. The role of the “Chinese demand factor” in the international gold futures market is exaggerated, which is consistent with the findings of CHEN et al [40].

In summary, the financial factors including the US Dollar Index, Volatility Index and federal funds rate have significant impacts on the international gold futures price volatility, which indicates that financial factors play an important role in the international gold futures market. In addition, the speculation factors also affect the price volatility of gold futures to a certain degree.

Table 3 Contributions of various shocks to gold futures price volatility

4 Conclusions

(1) Supply and demand factors still play a fundamental role in the international gold futures price volatility. The impact of China’s gold import as a representative of “China’s demand factor” is weak, and thus the role of “China’s demand factor” in the international gold futures market is exaggerated.

(2) Financial factors have a significant influence on the international gold futures prices volatility, of which the US dollar index has the greatest impact. These results show that under the background of increasing financialization in commodity markets, the financial factors have become increasingly important in the international gold market, due to the financial property of gold.

(3) Speculation factors can lead to volatility in the international gold futures markets, and may distort gold futures prices away from their fundamental values. Speculation in gold futures market should not be underestimated.

(4) China should enhance the importance of gold futures from a strategic perspective. Facing the current sluggish economy and unstable world pattern, the increase in holdings of gold futures can optimize the structure of foreign exchange reserves, hedge against the US dollar and reduce the impact of the depreciation of the US dollar on China’s economy.

(5) For gold futures investors, it is necessary to pay full attention to the changes of financial factors, including the exchange rate of US dollar, interest rate, stock market volatility and so on. When the global economic environment changes dramatically, investors can use the hedging function of gold futures to avoid investment losses.

(6) In order to curb and prevent price volatility caused by excessive speculation in gold futures market, the departments concerned are supposed to formulate restrictive policies of gold futures speculation and give a closer supervision to speculative activities.

References

[1] Baur D G, Lucey B M. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold [J]. Financial Review, 2010, 45(2): 217-229.

[2] Batchelor R, Gulley D. Jewellery demand and the price of gold [J]. Resources Policy, 1995, 21(1): 37-42.

[3] Kanjilal K, Ghosh S. Income and price elasticity of gold import demand in India: Empirical evidence from threshold and ARDL bounds test cointegration [J]. Resources Policy, 2014, 41: 135-142.

[4] Streifel S. Impact of China and India on global commodity markets: Focus on metals and minerals and petroleum [R]. Washington: Development Prospects Group/World Bank, UU World Investment Report, 2006.

[5] Owusu O, Wireko I, Mensah A K. The performance of the mining sector in Ghana: A decomposition analysis of the relative contribution of price and output to revenue growth [J]. Resources Policy, 2016, 50: 214-223.

[6] Silvennoinen A, Thorp S. Financialization, crisis and commodity correlation dynamics [J]. Journal of International Financial Markets, Institutions and Money, 2013, 24: 42-65.

[7] Henderson B J, Pearson N D, Wang Li. New evidence on the financialization of commodity markets [J]. The Review of Financial Studies, 2014, 28(5): 1285-1311.

[8] Basak S, Pavlova A. A model of financialization of commodities [J]. The Journal of Finance, 2016, 71(4): 1511-1556.

[9] Capie F, Mills T C, Wood G. Gold as a hedge against the dollar [J]. Journal of International Financial Markets, Institutions and Money, 2005, 15(4): 343-352.

[10] Pukthuanthong K, Roll R. Gold and the dollar (and the Euro, Pound, and Yen) [J]. Journal of Banking & Finance, 2011, 35(8): 2070-2083.

[11] Beckmann J, Czudaj R, Pilbeam K. Causality and volatility patterns between gold prices and exchange rates [J]. The North American Journal of Economics and Finance, 2015, 34: 292-300.

[12] Bilgin M H, Gozgor G, Lau C K M, SHENG Xin. The effects of uncertainty measures on the price of gold [J]. International Review of Financial Analysis, 2018, 58: 1-7.

[13] Wang Yu-shan, Chueh Yen-lin. Dynamic transmission effects between the interest rate, the US dollar, and gold and crude oil prices [J]. Economic Modelling, 2013, 30: 792-798.

[14] Hassani H, Silva E S, Gupta R, SEGNON M K. Forecasting the price of gold [J]. Applied Economics, 2015, 47(39): 4141-4152.

[15] Zhu Xue-hong, Chen Jin-yu, Zhong Mei-rui. Dynamic interacting relationships among international oil prices, macroeconomic variables and precious metal prices [J]. Transactions of Nonferrous Metals Society of China, 2015, 25(2): 669-676.

[16] Zhang Chuan-guo, Shi Xue-yang, Yu Dan-lin. The effect of global oil price shocks on China’s precious metals market: A comparative analysis of gold and platinum [J]. Journal of Cleaner Production, 2018, 186: 652-661.

[17] Bosch D, Pradkhan E. The impact of speculation on precious metals futures markets [J]. Resources Policy, 2015, 44: 118-134.

[18] Algieri B, Leccadito A. Price volatility and speculative activities in futures commodity markets: A combination of combinations of p-values test [J]. Journal of Commodity Markets, 2019, 13: 40-54.

[19] Zhu Xue-hong, Zhang Hong-wei, Zhong Mei-rui. Volatility forecasting in Chinese nonferrous metals futures market [J]. Transactions of Nonferrous Metals Society of China, 2017, 27(5): 1206-1214.

[20] Zhang Hong-wei, Zhu Xue-hong, Guo Yao-qi, LIU Hai-bo. A separate reduced-form volatility forecasting model for nonferrous metal market: Evidence from copper and aluminum [J]. Journal of Forecasting, 2018, 37(7): 754-766.

[21] Batten J A, Ciner C, Lucey B M. The macroeconomic determinants of volatility in precious metals markets [J]. Resources Policy, 2010, 35(2): 65-71.

[22] Lee Wo-chiang, Lin Hui-na. Threshold effects in the relationships between USD and gold futures by panel smooth transition approach [J]. Applied Economics Letters, 2012, 19(11): 1065-1070.

[23] SouCek M. Crude oil, equity and gold futures open interest co-movements [J]. Energy Economics, 2013, 40: 306-315.

[24] Zhu Xue-hong, Zhang Hong-wei, Zhong Mei-rui. Volatility forecasting using high frequency data: The role of after-hours information and leverage effects [J]. Resources Policy, 2017, 54: 58-70.

[25] SHI Bai-sheng, ZHU Xue-hong, ZHANG Hong-wei, ZENG Yi. Volatility–volume relationship of Chinese copper and aluminum futures market [J]. Transactions of Nonferrous Metals Society of China, 2018, 28(12): 2607-2618.

[26] Fang Li-bing, Yu Hong-hai, Xiao Wen. Forecasting gold futures market volatility using macroeconomic variables in the United States [J]. Economic Modelling, 2018, 72: 249-259.

[27] GONG Xu, LIN Bo-qiang. Structural breaks and volatility forecasting in the copper futures market [J]. Journal of Futures Markets, 2018, 38(3): 290-339.

[28] LIN Bo-qiang, LIU Chang. Why is electricity consumption inconsistent with economic growth in China? [J]. Energy Policy, 2016, 88: 310-316.

[29] CHEN Hao, LIAO Hua, TANG Bao-jun, WEI Yi-ming. Impacts of OPEC’s political risk on the international crude oil prices: An empirical analysis based on the SVAR models [J]. Energy Economics, 2016, 57: 42-49.

[30] Hu Chun-yan, Liu Xin-heng, Pan Bin, CHEN Bin, XIA Xiao-hua. Asymmetric impact of oil price shock on stock market in China: A combination analysis based on SVAR model and NARDL model [J]. Emerging Markets Finance and Trade, 2018, 54(8): 1693-1705.

[31] Chen Jin-yu, Zhu Xue-hong, Zhong Mei-rui. Nonlinear effects of financial factors on fluctuations in nonferrous metals prices: A Markov-switching VAR analysis [J]. Resources Policy, 2018, 61, 489-500.

[32] Wind Information Technology Ltd. WIND database [EB/OL]. http://www.wind.com.cn. 2018.

[33] Anzuini A, Lombardi M J, Pagano P. The impact of monetary policy shocks on commodity prices [R]. Rome: Bank of Italy, 2012.

[34] FAN Ying, XU Jin-hua. What has driven oil prices since 2000? A structural change perspective [J]. Energy Economics, 2011, 33(6): 1082-1094.

[35] Yang Cai, Gong Xu, Zhang Hong-wei. Volatility forecasting of crude oil futures: The role of investor sentiment and leverage effect [J]. Resources Policy, 2018, 61: 548-563.

[36] GONG Xu, LIN Bo-qiang. The incremental information content of investor fear gauge for volatility forecasting in the crude oil futures market [J]. Energy Economics, 2018, 74: 270-286.

[37] HAN Li-yan, YIN Li-bo. Speculation or real demand? A multi-vision economic analysis of the international commodity prices impact factors [J]. Economic Research Journal, 2012, 12: 83-96.

[38] Wen Feng-hua, Xiao Ji-hong, Huang Chuang-xia, XIA Xiao-hua. Interaction between oil and US dollar exchange rate: Nonlinear causality, time-varying influence and structural breaks in volatility [J]. Applied Economics, 2018, 50(3): 319-334.

[39] Haase M, Zimmermann Y S, Zimmermann H. The impact of speculation on commodity futures markets—A review of the findings of 100 empirical studies [J]. Journal of Commodity Markets, 2016, 3(1): 1-15.

[40] Chen Yu-feng, YU Jian, Kelly P. Does the China factor matter: What drives the surge of world crude oil prices? [J]. The Social Science Journal, 2016, 53(1): 122-133.

王 灏1,盛 虎1,张宏伟2,3

1. 中南大学 商学院,长沙 410083;

2. 中南大学 数学与统计学院,长沙 410083;

3. 中南大学 金属资源战略研究院,长沙 410083

摘 要:从黄金的商品属性和金融属性出发,以国际黄金期货市场为研究对象,从供求因素、金融因素和投机因素3个方面分析国际黄金期货价格波动的影响因素。应用结构向量自回归(SVAR)模型研究影响因素对国际黄金期货价格作用的方向和强度,并用方差分解法(VDA)比较这些因素的贡献度。结果表明,供需因素仍然对国际黄金期货价格波动起基础性作用,而“中国黄金需求”在国际黄金期货市场中的作用被夸大。金融因素和投机因素对国际黄金期货价格波动有显著影响,这一结果反映出黄金的金融属性变得日益重要。政府与投资者应当高度关注黄金期货的金融属性。

关键词:黄金期货;供需因素;金融因素;投机;结构向量自回归(SVAR)模型

(Edited by Bing YANG)

Foundation item: Projects (71874210, 71633006, 71501193) supported by the National Natural Science Foundation of China

Corresponding author: Hong-wei ZHANG; Tel: +86-15084949634; E-mail: hongwei@csu.edu.cn

DOI: 10.1016/S1003-6326(19)65151-4