人民币国际化与有色金属价格变动的非线性关系

来源期刊:中国有色金属学报(英文版)2020年第7期

论文作者:朱学红 张梓滔 张宏伟 汪秋芬

文章页码:1991 - 2000

关键词:人民币国际化;有色金属;非线性Granger因果关系;DCC-GARCH模型

Key words:RMB internationalization; nonferrous metals; nonlinear Granger causality test; DCC-GARCH model

摘 要:运用非线性Granger因果关系检验和DCC-GARCH模型,对人民币国际化和有色金属价格变动之间的关联性进行实证研究。结果表明:人民币国际化与有色金属价格变动之间的关联是复杂的非线性机制;在2009年7月开展人民币结算试点之前,人民币国际化与有色金属价格变动之间互不影响;然而,在人民币结算试点开展后,人民币国际化与铜价的互动表现为双向性;对铝而言,存在由铝价变动到人民币国际化的单向非线性因果关系。此外,受经济金融危机等极端事件的影响,人民币国际化与有色金属价格变动并不总是表现出正向关联,有时也呈现负相关性。

Abstract: The correlation between Renminbi (RMB) internationalization and nonferrous metal prices was studied using the nonlinear Granger causality test and the dynamic conditional correlation-generalized autoregressive conditional heteroskedastic (DCC-GARCH) model. The results indicate that the relationship between RMB internationalization and nonferrous metal prices reflects a complex nonlinear mechanism. There was no mutual influence between RMB internationalization and nonferrous metal prices prior to the trials of the RMB settlement in the cross-border trade in July 2009. Since then, however, a bidirectional causal relationship between RMB internationalization and the price of copper and a unidirectional causal relationship from the price of aluminum to RMB internationalization were examined. In addition, due to the impact of extreme events, such as economic and financial crises, RMB internationalization and nonferrous metal prices are not always positively correlated but are rather occasionally negatively correlated.

Trans. Nonferrous Met. Soc. China 30(2020) 1991-2000

Xue-hong ZHU1,2, Zi-tao ZHANG1, Hong-wei ZHANG2,3, Qiu-fen WANG1

1. School of Business, Central South University, Changsha 410083, China;

2. Institute of Metal Resources Strategy, Central South University, Changsha 410083, China;

3. School of Mathematics and Statistics, Central South University, Changsha 410083, China

Received 10 September 2019; accepted 18 May 2020

Abstract: The correlation between Renminbi (RMB) internationalization and nonferrous metal prices was studied using the nonlinear Granger causality test and the dynamic conditional correlation-generalized autoregressive conditional heteroskedastic (DCC-GARCH) model. The results indicate that the relationship between RMB internationalization and nonferrous metal prices reflects a complex nonlinear mechanism. There was no mutual influence between RMB internationalization and nonferrous metal prices prior to the trials of the RMB settlement in the cross-border trade in July 2009. Since then, however, a bidirectional causal relationship between RMB internationalization and the price of copper and a unidirectional causal relationship from the price of aluminum to RMB internationalization were examined. In addition, due to the impact of extreme events, such as economic and financial crises, RMB internationalization and nonferrous metal prices are not always positively correlated but are rather occasionally negatively correlated.

Key words: RMB internationalization; nonferrous metals; nonlinear Granger causality test; DCC-GARCH model

1 Introduction

The Renminbi (RMB) formally entered the special drawing rights (SDR) basket as its fifth member on October 1, 2016, which put it ahead of the Japanese yen and the British pound and behind only the U.S. dollar and the euro. This event marked a major step forward in RMB internationalization and was an important milestone in the development of the RMB. Further progress in RMB internationalization now awaits the acquisition of RMB’s pricing power in the commodity markets. It is well known that the internationalization of a currency must be supported by resources and that binding a currency with the pricing power of a commodity is an obligatory pathway to realization. In recent years, with the decline in the status of the dollar, there has been a growing trend toward the de-dollarization of commodities. This trend has coincided with the rise of China’s global status, and accordingly, the role of the RMB as an international currency has risen with China’s ascent. While over 60 countries hold RMB as part of their foreign exchange reserves, Iran has made the RMB its chief foreign exchange currency. Under these circumstances in which the RMB’s status and role in the global financial economy continue to rise, the effects of the RMB on commodity prices have become a focus of academic research. With the rise in the status of both China and the RMB, the RMB gains influence on nonferrous metal prices that cannot be ignored. Accordingly, investigating the correlation between RMB internationalization and nonferrous metal prices has major significance in the efforts to promote RMB internationalization and secure international pricing power of nonferrous metals.

The dollar has continued to serve as the international currency most commonly used in commodity pricing due to its dominant status. In addition to the traditional factors, such as supply and demand, commodity prices are increasingly subject to changes in the exchange rates of major international currencies (US dollar, etc.) [1,2], speculation in the international capital [3,4], monetary policy [5], market uncertainty [6] and other factors [7-10]. As petroleum is the most important energy product, its spot trading and derivatives have an important share in the market. Thus, many scholars have studied the relationship between petroleum and the dollar. By employing detrended cross-correlation analysis (DCCA), REBOREDO et al [11] discovered a negative correlation between petroleum prices and the dollar, although a positive correlation had existed between the two until the mid-20th century. Nonetheless, when the value of the dollar is high, a positive correlation still exists between oil prices and the dollar exchange rate [12]. Researchers’ efforts to test the causality between oil prices and the dollar have yielded different results. For example, VOVCHENKO et al [13] suggested that the increase in oil prices could cause the dollar exchange rate to increase, whereas CHEN et al [14] argued that oil prices are influenced by supply shocks, demand shocks, and other shocks. Moreover, they ruled out a nonlinear relationship between oil prices and the dollar and found that demand shocks and other shocks have long-run, significant effects on oil prices. However, when cointegration exists, the causality relationship between oil prices and the dollar remains to be seen. To resolve this problem, MCLEOD and HAUGHTON [15], using the threshold autoregressive (TAR) and momentum-TAR (MTAR) methods to study oil prices and the real dollar exchange rate, concluded that while the two methods had only unidirectional causation during long periods of time, they exhibited reciprocal causality during short periods of time. However, the dollar is not invulnerable. With the strong rise of the euro, which has mounted a fierce challenge to the dollar in some regions [16-18], and the RMB and the establishment of a new international monetary system, the pricing of commodities is likely to shift from pricing only in dollars to joint pricing in multiple currencies.

With the rise of China’s international status and the rapid internationalization of the RMB, the international monetary system may undergo a change and evolve into a multipolar international monetary system centered on the dollar, euro, and RMB. Such a situation could propel further internationalization of the RMB by giving RMB internationalization greater opportunities that could eventually enable the RMB to obtain, to a certain degree, pricing power in commodities [19]. Hence, in recent years, some studies have begun to examine the relationship between the RMB and commodity prices. By examining the world’s leading commodity, petroleum, LI et al [20] discovered that a bidirectional spillover effect exists between the RMB exchange rate and oil prices; this discovery implies not only that oil prices may affect the RMB exchange rate but also that, conversely, the RMB exchange rate may impact oil prices. However, when the research subjects are precious metals, the RMB exchange rate has only a unidirectional influence on precious metal prices, and this influence exists only in the short term [21]. In studies using a time-varying parameter structural vector autoregressive (TVP-VAR) model to determine the relationship between agricultural products and the RMB exchange rate, ZHENG [22] found that the impact of the RMB exchange rate on the import/export prices of agricultural products dynamically changes and exhibits major changes when there are shifts in the exchange rate system, indicating that even though the RMB influences the agricultural product prices, it has not acquired sufficient pricing power in leading agricultural products. Nonferrous metals, however, comprise an important commodity group that may be related to the internationalization of the RMB. Hence, the motivation for this study is to determine whether there is a connection between the RMB internationalization and the nonferrous metal prices.

Scholars have already undertaken preliminary research on the interactive relationships among the dollar, the RMB, and commodity prices, and while they have achieved some progress, certain deficiencies remain. As the majority of the research on this topic has focused on the interactive relationship between the dollar and oil prices, there has been little research on the important commodity category of nonferrous metals. Furthermore, because the internationalization of the RMB only began progressing during the last few years, there have been even fewer papers on the relationship between the RMB and nonferrous metal prices. Regarding the research methods, while existing research on this topic has primarily employed linear models, major changes in commodity pricing models have accompanied the rise of financialization and indexing investment, and hence, commodity prices invariably exhibit nonlinear and dynamic characteristics. Thus, it is necessary to go beyond the linear paradigms, e.g., the VAR models that are used in existing research. This study selected the nonferrous metals of copper and aluminum as its subjects and employed the nonlinear Granger causality test and a dynamic conditional correlation-generalized autoregressive conditional heteroskedastic (DCC-GARCH) model to study the relationship between RMB internationalization and nonferrous metal prices, as well as the evolution patterns of this relationship, from a new perspective that incorporates nonlinear and dynamic analyses.

2 Research method

2.1 Nonlinear Granger causality test

Although most existing research on this subject has been based on linear relations that are nearly nonexistent in the real world. Accordingly, if linear methods are used to estimate nonlinear relations, the accuracy of the results could be negatively impacted. To resolve this problem, BAEK and BROCKW [23] proposed a method for estimating nonlinear relations, and HIEMSTRA and JONES [24] revised this method to increase its applicability. Nonetheless, the problem of over rejection remained. Consequently, DIKS and PANCHENKO [25] proposed an adjustable bandwidth method that reduces the effects of changes in the conditional distribution and increases the stability of the results. The greatest advantage of this method is that, providing the time series is stationary, the method can be used to test the series, no matter the distribution of the series. Therefore, in this study, this method is used to describe the relationship between RMB internationalization and nonferrous metal prices. The method’s basic principles are as follows.

Assuming that there are two series {Xt} and {Yt}, where t=1, 2, …, N, both series are stationary, and the two series have lag orders of lx and ly, respectively, where lx and ly are both positive integers greater than 0; then, the obtained lag matrices are  and

and  , in which case the null hypothesis is as follows:

, in which case the null hypothesis is as follows:

(1)

(1)

This hypothesis implies that Granger causality does not exist between the two series.

We set  , where Zt=Yt+1. If Eq. (1) is established, then Wt maintains its original distribution. When lx=ly=1, then

, where Zt=Yt+1. If Eq. (1) is established, then Wt maintains its original distribution. When lx=ly=1, then  and

and  Therefore, no Granger causality exists between {Xt} and {Yt}, and the conditional distribution of Z given (X, Y)=(x, y) is equivalent to the conditional distribution of Z given Y=y. At this time, the null hypothesis is expressed as

Therefore, no Granger causality exists between {Xt} and {Yt}, and the conditional distribution of Z given (X, Y)=(x, y) is equivalent to the conditional distribution of Z given Y=y. At this time, the null hypothesis is expressed as

(2)

(2)

and Eq. (3) is established as

q≡E[fX, Y, Z(x, y, z)fY(y)-fX, Y(x, y)fY, Z(y, z)]=0 (3)

The estimated value of the local density function of a random vector W at the value Wi is expressed as  :

:

(4)

(4)

where  , I(·) is an indicator function and εn is a bandwidth parameter that is related to the sample. With

, I(·) is an indicator function and εn is a bandwidth parameter that is related to the sample. With  , a Tn following a normal distribution is obtained, as shown in Eq. (5), which can be further standardized as Eq. (6):

, a Tn following a normal distribution is obtained, as shown in Eq. (5), which can be further standardized as Eq. (6):

(5)

(5)

(6)

(6)

Here,  indicates a convergence of the distribution, and Sn indicates that Tn(·) is the estimated value of the asymptotic variance.

indicates a convergence of the distribution, and Sn indicates that Tn(·) is the estimated value of the asymptotic variance.

2.2 DCC-GARCH model

The DCC-GARCH model proposed by ENGLE [26] was selected for this study because of its good time coupling and its ability to measure the dynamic changes in series’ correlation coefficients. In addition, this model can ignore the conditional heteroscedasticity between different series, thus increasing the model’s applicability and broadening its range of use.

Let rt=(r1t, r2t)′ be a 2×T vector containing the data series.

rt=(r1t, r2t)′|It-1~N(0, Ht) (7)

Ht=DtRtDt (8)

where It-1 represents the information set during period t-1, Rt is the time-variant correlation coefficient matrix, and the time-varying standard deviation matrix is  .

.

When the standardized residual of the univariate GARCH model is  , where εit~N(0,Rt), the DCC exhibits the following structure:

, where εit~N(0,Rt), the DCC exhibits the following structure:

(9)

(9)

(10)

(10)

where Qt is a time-varying covariance matrix (n×n) of the standardized residual uit, and Q=E(utu′t).

This model is used to perform the estimation via two steps. In the first step, the univariate GARCH model is employed to perform the estimation and calculate the residual. In the second step, the maximum likelihood estimation (MLE) method is used in conjunction with these results to calculate the parameters of the dynamic structure.

3 Selection of variables and analysis of empirical results

3.1 Data specifications

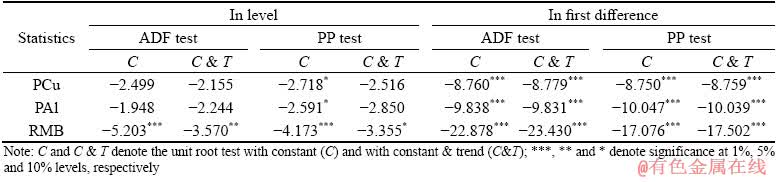

There are many methods of determining the RMB’s internationalization index. Among them, the indices calculated by the International Monetary Institute of Renmin University of China [27] are based on the international payment and reserve functions and can be used to effectively assess the degree of internationalization. However, the RMB internationalization indices that are determined using this method are only applicable to data after 2010, thus resulting in too little data and implying that this method cannot readily meet the needs of quantitative testing. SHA and LIU [28] employed Hong Kong’s RMB deposit balance as an index of RMB internationalization, which reflected that Hong Kong was the place where the earliest offshore RMB deposits were permitted and continued to have greater RMB deposits than those of other countries or territories, thus facilitating data collection. Adopting the method of SHA and LIU [28], this study consequently employs Hong Kong’s RMB deposit balance as an RMB internationalization assessment index. It was necessary to select certain nonferrous metals for this study because it would have been too difficult to assess each of the many types of nonferrous metals. This study adopted copper and aluminum as the representative nonferrous metals. Compared with the domestic metal trading market, the London Metal Exchange (LME), which was established earlier, had a more perfect system and exhibited greater influence on the market. Therefore, the copper and aluminum futures closing prices of the LME were selected. Our dataset consists of monthly data from March 2004 to March 2019, thus resulting in 181 observations. All data were obtained from the WIND database. To eliminate heteroscedasticity, the variables of the RMB internationalization index and the copper and aluminum prices were transformed into logarithmic values, which are denoted as RMB, PCu and PAl, respectively. The augmented Dicky-Fuller (ADF) and Phillips-Perron (PP) tests were used to verify the stationarity of the variables, and the results presented in Table 1 indicate that the variables PCu, PAl and RMB are stationary at the 5% significance level in terms of first differences (recorded as DPCu, DPAl and DRMB, respectively) with intercept and time trend.

3.2 Nonlinear analysis of RMB inter- nationalization and nonferrous metal prices

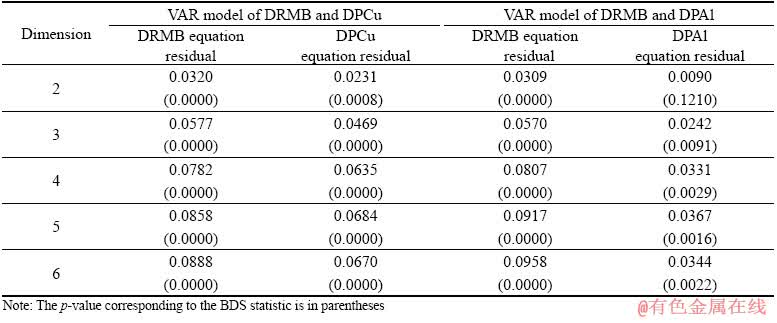

Before performing nonlinear Granger causality test, it was necessary to determine whether the nonlinear relationships existed between RMB internationalization and nonferrous metal prices. To perform this determination, a VAR model with the optimal lag order was used to estimate the interaction between RMB internationalization and copper (aluminum) prices with the goal to eliminate any linear components. The BDS test proposed by BROOCK et al [29] was applied on the residuals. The testing results reported in Table 2 indicate that the null of the i.i.d. residuals at the vast majority of the embedding dimensions is rejected strongly at the significant level of 1%, thereby providing strong evidence of nonlinearity in the relationship between RMB internationalization and nonferrous metal prices.

3.3 Nonlinear Granger causality test

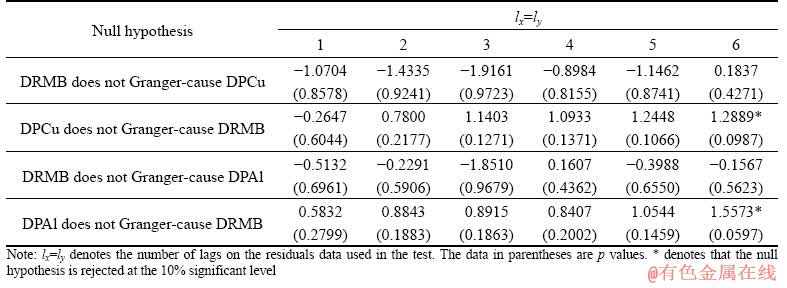

Given the strong evidence of nonlinearity, we now turn to the nonlinear Granger causality. The results in Table 3 reveal that the null hypothesis of no Granger causality between DRMB and DPCu (DPAl) cannot be rejected at the significant level of 5%, thus indicating that nonlinear Granger causality does not exist between RMB internationalization and copper (aluminum) prices throughout the entire interval.

Table 1 Results of unit root analysis

Table 2 Nonlinear relationship between RMB internationalization and nonferrous metal prices

Table 3 Results of nonlinear Granger causality test

The State Council decided to establish a pilot program on the RMB cross-border settlement in five cities, including Shanghai, which allowed the RMB to be used for trade with Hong Kong and Macau on April 8, 2009. On July 2, 2009, the pilot program formally opened with the announcement of the Notice of the People’s Bank of China on Issuing the Detailed Rules for the Implementation of the Measures for the Administration of Pilot RMB Settlement in Cross-border Trade, and the strong promotion of RMB internationalization began. To investigate the interaction between RMB internationalization and nonferrous metal prices before and after the initiation of the pilot program on the RMB cross-border settlement, we selected July 2009, which was the time when the pilot program was initiated, as the dividing point to assess the nonlinear evolution of the relationship between RMB internationalization and nonferrous metal prices.

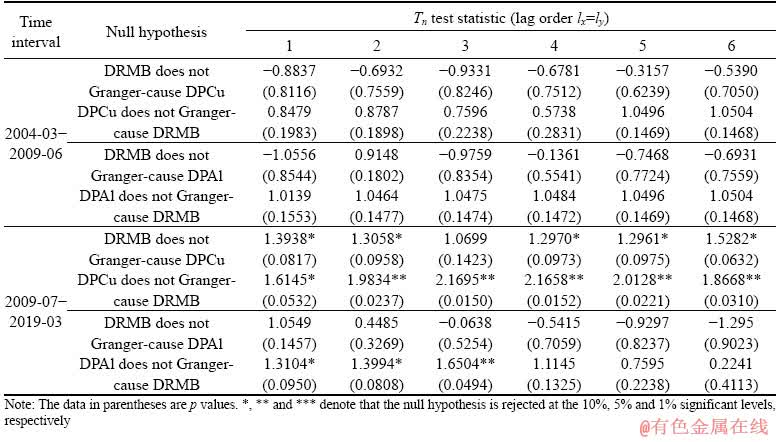

Table 4, which presents the results of the nonlinear Granger causality test before and after the initiation of the pilot program, indicates that the nonlinear Granger causality between RMB internationalization and copper (aluminum) prices did not exist between March 2004 and June 2009, i.e., before the initiation of the pilot program. However, the nonlinear Granger causality test rejects the null hypothesis that DRMB does not Granger-cause DPCu at the significant level of 10% in most cases during the period between July 2009 and March 2019. Moreover, the null hypothesis that DPCu does not Granger-cause DRMB is also rejected at the significant level of 10% for all cases during the July 2009 to March 2019 period. This finding further indicates that the bidirectional nonlinear Granger causality existed between RMB internationalization and copper prices during this period, a result that may be because the initiation of the pilot program regarding the RMB cross-border settlement in July 2009 expanded the scope of the RMB’s use in the international trade system, enhanced the RMB’s status, and triggered the rapid progress of RMB internationalization. As a result, the relationship between RMB internationalization and nonferrous metal prices began to evolve. On one hand, the fact that RMB internationalization influences the price of copper, which is priced in dollars, suggests that RMB internationalization is facilitating the overthrow of the dollar’s hegemony and gives the pricing power to the RMB with respect to copper. On the other hand, the fact that the price of copper is a nonlinear Granger cause of RMB internationalization indicates that the copper price is promoting the acceleration of RMB internationalization. The arrival of the global financial crisis and European debt crisis in quick succession weakened the economic growth in the United States and in the European countries, and thus, their international statuses declined. However, for its part, China was able to maintain steady growth, and it easily weathered the global financial crisis. Moreover, the influence of the RMB continued to rise, and some Asian countries have already regarded it as a reference currency. As one of the five BRICS, China is still ascending and demonstrates vast developmental potential, while the RMB has significantly appreciated in recent years and is finding favor with a growing number of countries. To a certain extent, the RMB is even more welcome than the dollar, with copper prices having weakened the dollar and inducing investors to shift to the RMB market, which indirectly promotes RMB internationalization.

Table 4 Results of nonlinear Granger causality test before and after initiation of pilot program on RMB cross- border settlement

In the case of the relationship between RMB internationalization and aluminum prices, the null hypothesis of no Granger causality from DPAl to DRMB is rejected at the significant level of 10% for the lag orders of 1 to 3. This reveals that aluminum prices have unidirectional nonlinear Granger causation on RMB internationalization, indicating that aluminum price changes have promoted the advancement of RMB internationalization, albeit RMB internationalization has not influenced aluminum prices. This outcome occurs because China has not yet obtained pricing power in aluminum, and thus, the RMB internationalization process cannot readily impact aluminum pricing.

In short, prior to the initiation of the pilot program on the RMB cross-border settlement, no nonlinear Granger causality existed between RMB internationalization and copper (aluminum) prices, indicating that there was no interaction between RMB internationalization and nonferrous metal prices. After the initiation of the pilot program, however, the relationship between RMB internationalization and copper (aluminum) prices shifted from nonexistent to a complex nonlinear mechanism, and RMB internationalization exhibited different correlations and different causalities with copper prices separate from aluminum prices. This outcome reveals that the establishment of the pilot program on RMB cross-border settlement was an important turning point and a key step in the internationalization of the RMB.

3.4 Dynamic correlation between RMB internationalization and nonferrous metal prices using DCC-GARCH model

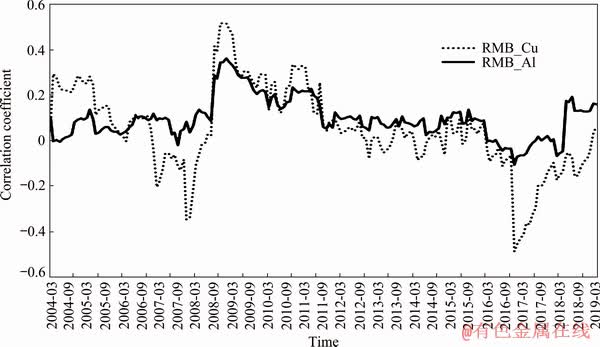

The DCC coefficient is an important assessment indicator of the degree of convergence between variables. A large dynamic correlation coefficient indicates that a high degree of convergence exists between variables and that there is a relatively high degree of linkage. Conversely, a low correlation coefficient indicates that the variables’ trends largely diverge, and thus, there is a significant deviation. To present the changes in the DCC coefficients of the relationship between RMB internationalization and copper and aluminum prices in a more intuitive manner, the DCC coefficients are plotted in Fig. 1.

Fig. 1 DCC coefficient of RMB internationalization and nonferrous metal prices

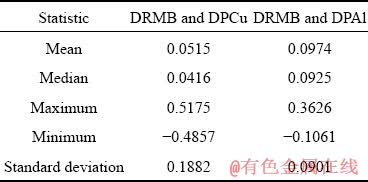

This chart reveals that the correlation coefficients of RMB internationalization and copper and aluminum prices are not constant. The correlation coefficients constantly change over time and thus exhibit time-varying characteristics. Generally, dynamic correlation coefficients have positive values. In keeping with this typical situation, RMB internationalization and copper and aluminum prices have positive correlations during most periods and only rarely exhibit negative correlations. When copper and aluminum are examined separately, RMB internationalization is positively correlated with aluminum prices, but it is both positively and negatively correlated with copper prices. For example, RMB internationalization exhibited negative correlations with copper prices during the periods of February 2007 to June 2008 and December 2016 to December 2018. These negative correlations may be largely attributable to events such as the global financial crisis and China-U.S. trade frictions. The descriptive statistics of the DCC coefficients of the relationship between RMB internationalization and copper and aluminum prices are reported in Table 5.

Table 5 Basic statistical characteristics of dynamic conditional correlation coefficients

The statistical characteristics of the DCC coefficients indicate that the means of DCC coefficients between RMB internationalization and copper and aluminum prices are 0.0515 and 0.0974, respectively, and the medians are 0.0416 and 0.0925, respectively. These results suggest that positive correlations usually exist between RMB internationalization and the price of copper (aluminum) and that the correlation between RMB internationalization and the price of aluminum is substantially stronger. In addition, while the DCC coefficient chart further indicates that the dynamic correlation coefficients of RMB internationalization and the price of copper exhibited large fluctuations prior to 2009, these fluctuations tended to stabilize after 2009. The correlation coefficients again began to fluctuate significantly after 2017, although the majority of the correlation coefficients were between 0.1 and 0.3. Compared with the DCC coefficients of RMB internationalization and the price of copper, the DCC coefficients of RMB internationalization and the aluminum prices have been relatively stable and have remained, for the most part, between 0.1 and 0.2.

4 Conclusions

(1) Considering the initiation of the pilot program on RMB cross-border settlement in July 2009 as a turning point, the relationship between RMB internationalization and nonferrous metal prices began to exhibit different causal linkages. In general, RMB internationalization and nonferrous metal prices had no mutual interactions prior to the initiation of the pilot program on RMB cross-border settlement. After the establishment of the pilot program on RMB cross-border settlement, however, bidirectional nonlinear causality was observed between RMB internationalization and copper prices. In the case of aluminum, only unidirectional nonlinear causality from aluminum prices to RMB internationalization existed, and the RMB internationalization exhibited only a weak impact on aluminum pricing.

(2) A positive correlation generally existed between RMB internationalization and aluminum prices, while RMB internationalization maintained a positive correlation with copper prices during long cyclic periods. However, due to the financial crisis and China-U.S. trade frictions, a negative correlation sometimes existed between RMB internationalization and copper prices.

(3) The nonferrous metal prices had an active promotional effect on RMB internationalization, indicating that nonferrous metals can serve as effective carriers of RMB internationalization. Thus, China can couple the RMB with nonferrous metal demands, encourage more enterprises to enter the international nonferrous metals financial market, establish a nonferrous metal-RMB system, and promote the creation of a new pathway for the RMB’s rise as a sovereign currency in the international nonferrous metals trade.

References

[1] MCCALLA A F. World food prices: Causes and consequences [J]. Canadian Journal of Agricultural Economics/Revue Canadienne Dagroeconomie, 2010, 57(1): 23-34.

[2] HARRI A, NALLEY L, HUDSON D. The relationship between oil, exchange rates, and commodity prices [J]. Journal of Agricultural and Applied Economics, 2009, 41(2): 501-510.

[3] MASTERS M W. Testimony before the committee on homeland security and governmental affairs [J]. US Senate, 2008, 20: 34-79.

[4] TANG K, XIONG W, LIN P. Index investment and the financialization of commodities [J]. Financial Analyst Journal, 2012, 68(6): 54-74.

[5] WEN F, MIN F, ZHANG Y J, YANG C. Crude oil price shocks, monetary policy, and China’s economy [J]. International Journal of Finance & Economics, 2019, 24(2): 812-827.

[6] WEN F, ZHAO Y, ZHANG M, HU C. Forecasting realized volatility of crude oil futures with equity market uncertainty [J]. Applied Economics, 2019, 51(59): 6411-6427.

[7] ZHANG H, ZHU X, GUO Y, LIU H. A separate reduced-form volatility forecasting model for nonferrous metal market: Evidence from copper and aluminum [J]. Journal of Forecasting, 2018, 37(7): 754-766.

[8] ZHU X, ZHANG H, ZHONG M. Volatility forecasting using high frequency data: The role of after-hours information and leverage effects [J]. Resources Policy, 2017, 54: 58-70.

[9] YANG C, GONG X, ZHANG H. Volatility forecasting of crude oil futures: The role of investor sentiment and leverage effect [J]. Resources Policy, 2019, 61: 548-563.

[10] GAO C, YOU D M, CHEN J. Dynamic response pattern of gold prices to economic policy uncertainty [J]. Transactions of Nonferrous Metals Society of China, 2019, 29(12): 2667-2676.

[11] REBOREDO J C, RIVERA-CASTRO M A, ZEBENDE G F. Oil and US dollar exchange rate dependence: A detrended cross-correlation approach[J]. Energy Economics, 2014, 42: 132-139.

[12] COUDERT V, MIGNON V. Reassessing the empirical relationship between the oil price and the dollar [J]. Energy Policy, 2016, 95: 147-157.

[13] VOVCHENKO N G, POPKOVA E G, EPIFANOVA T V, POGORELENKO N S. The relationship between the oil price and the US dollar [J]. Journal of Business and Retail Management Research, 2018, 12(3): 220-230.

[14] CHEN H, LIU L, WANG Y, ZHU Y. Oil price shocks and U.S. dollar exchange rates [J]. Energy, 2016, 112: 1036-1048.

[15] MCLEOD R C D, HAUGHTON A Y. The value of the US dollar and its impact on oil prices: Evidence from a non-linear asymmetric cointegration approach [J]. Energy Economics, 2018, 70: 61-69.

[16] KAMPS A. The euro as invoicing currency in international trade [J]. 2006. https://papers.ssrn.com/.

[17] LIGTHART J E, WERNER S E V. Has the euro affected the choice of invoicing currency? [J]. Journal of International Money and Finance, 2012, 31(6): 1551-1573.

[18] CHINN M, FRANKEL J A. Why the euro will rival the dollar [J]. International Finance, 2010, 11(1): 49-73.

[19] CAMPANELLA M. The internationalization of the RMB and the rise of a multipolar monetary system [J]. Journal of Self-Governance and Management Economics, 2014, 2(3): 72-93.

[20] LI Jian-feng, LU Xin-sheng, JIANG Wei. Empirical analysis of the relationship between monetary policy, RMB exchange rate and international crude oil market [J]. Statistics & Decision, 2018, 34(18): 154-157. (in Chinese)

[21] ZHU X H, CHEN J Y, ZHONG M R. Dynamic interacting relationships among international oil prices, macroeconomic variables and precious metal prices [J]. Transactions of Nonferrous Metals Society of China, 2015, 25(2): 669-676.

[22] ZHEGN Yan. Research on the dynamic pass-through effect of the RMB exchange rate on China’s agricultural products’ import and export prices based on the TVP-VAR model [J]. International Business (Journal of University of International Business and Economics), 2018(1): 23-37. (in Chinese)

[23] BAEK E G, BROCKW A. A nonparametric test for independence of a multivariate time series [J]. Statistica Sinica, 1992, 2(1): 137-156.

[24] HIEMSTRA C, JONES J. Testing for linear and nonlinear granger causality in the stock price-volume relation [J]. The Journal of Finance, 1994, 49(5): 1639-1664.

[25] DIKS C, PANCHENKO V. A new statistic and practical guidelines for nonparametric Granger causality testing [J]. Journal of Economic Dynamics and Control, 2006, 30(9-10): 1647-1669.

[26] ENGLE R. Dynamic conditional correlation[J]. Journal of Business & Economic Statistics, 2002, 20(3): 339-350.

[27] International Monetary Institute (IMI), Renmin University of China. Report on RMB Internationalization [R]. Beijing: China Renmin University Press, 2010. (in Chinese)

[28] SHA Wen-bing, LIU Hong-zhong. RMB internationalization, exchange rate change and exchange rate expectation [J]. Studies of International Finance, 2014(8): 10-18. (in Chinese)

[29] BROOCK W A, SCHEINKMAN J A, DECHERT W D, LEBARON B. A test for independence based on the correlation dimension [J]. Econometric Reviews, 1996, 15(3): 197-235.

朱学红1,2,张梓滔1,张宏伟2,3,汪秋芬1

1. 中南大学 商学院,长沙 410083;

2. 中南大学 金属资源战略研究院,长沙 410083;

3. 中南大学 数学与统计学院,长沙 410083

摘 要:运用非线性Granger因果关系检验和DCC-GARCH模型,对人民币国际化和有色金属价格变动之间的关联性进行实证研究。结果表明:人民币国际化与有色金属价格变动之间的关联是复杂的非线性机制;在2009年7月开展人民币结算试点之前,人民币国际化与有色金属价格变动之间互不影响;然而,在人民币结算试点开展后,人民币国际化与铜价的互动表现为双向性;对铝而言,存在由铝价变动到人民币国际化的单向非线性因果关系。此外,受经济金融危机等极端事件的影响,人民币国际化与有色金属价格变动并不总是表现出正向关联,有时也呈现负相关性。

关键词:人民币国际化;有色金属;非线性Granger因果关系;DCC-GARCH模型

(Edited by Xiang-qun LI)

Foundation item: Projects (71874210, 71633006, 71874207, 71974208) supported by the National Natural Science Foundation of China; Project (2020CX049) supported by Innovation-Driven Foundation of Central South University, China; Project (2018dcyj031) supported by Postgraduate Survey Research Foundation of Central South University, China; Project (17K103) supported by the Innovation Platform Open Fund Project of Hunan Education Department, China

Corresponding author: Hong-wei ZHANG; Tel: +86-15084949634; E-mail: hongwei@csu.edu.cn

DOI: 10.1016/S1003-6326(20)65356-0