中国有色金属期货市场波动率预测

来源期刊:中国有色金属学报(英文版)2017年第5期

论文作者:朱学红 张宏伟 钟美瑞

文章页码:1206 - 1214

关键词:波动率预测;杠杆效应;波动时变性;有色金属期货;高频数据

Key words:volatility forecasting; leverage effect; time-varying volatility; nonferrous metals futures; high-frequency data

摘 要:运用高频金融数据建模和预测中国有色金属期货市场波动率,并探索已实现波动率的波动时变性和杠杆效应。拓展了LHAR-CJ模型,并对上海期货交易所铜和铝期货进行实证研究。研究表明,已实现波动率存在动态依赖性和时变性,它们均可通过长记忆性的HAR-GARCH结构体现。此外,中国有色金属期货市场波动率存在显著的周杠杆效应。最后,样本内预测和样本外预测的结果表明,考虑了已实现波动率的波动时变性和杠杆效应的HAR-CJ-G模型能有效地提高解释能力和样本外预测能力。

Abstract: This paper seeks to model and forecast the Chinese nonferrous metals futures market volatility and allows new insights into the time-varying volatility of realized volatility and leverage effects using high-frequency data. The LHAR-CJ model is extended and the empirical research on copper and aluminum futures in Shanghai Futures Exchange suggests the dynamic dependencies and time-varying volatility of realized volatility, which are captured by long memory HAR-GARCH model. Besides, the findings also show the significant weekly leverage effects in Chinese nonferrous metals futures market volatility. Finally, in-sample and out-of-sample forecasts are investigated, and the results show that the LHAR-CJ-G model, considering time-varying volatility of realized volatility and leverage effects, effectively improves the explanatory power as well as out-of sample predictive performance.

Trans. Nonferrous Met. Soc. China 27(2017) 1206-1214

Xue-hong ZHU1,2, Hong-wei ZHANG1,2, Mei-rui ZHONG1,2

1. School of Business, Central South University, Changsha 410083, China;

2. Institute of Metal Resources Strategy, Central South University, Changsha 410083, China

Received 29 January 2016; accepted 15 August 2016

Abstract: This paper seeks to model and forecast the Chinese nonferrous metals futures market volatility and allows new insights into the time-varying volatility of realized volatility and leverage effects using high-frequency data. The LHAR-CJ model is extended and the empirical research on copper and aluminum futures in Shanghai Futures Exchange suggests the dynamic dependencies and time-varying volatility of realized volatility, which are captured by long memory HAR-GARCH model. Besides, the findings also show the significant weekly leverage effects in Chinese nonferrous metals futures market volatility. Finally, in-sample and out-of-sample forecasts are investigated, and the results show that the LHAR-CJ-G model, considering time-varying volatility of realized volatility and leverage effects, effectively improves the explanatory power as well as out-of sample predictive performance.

Key words: volatility forecasting; leverage effect; time-varying volatility; nonferrous metals futures; high-frequency data

1 Introduction

Nonferrous metal commodities play a very significant role in national economies, since they are more and more demanded by other types of market participants and their prices have an impact on the extraction, processing and manufacturing sectors. For example, aluminum is an energy-intensive commodity and copper is a base metal, and they all have major role in industrial production and manufacturing. However, nonferrous metals prices are easily influenced by speculators, especially in our recent emerging economies. The increase of uncertain factors such as the change of exchange rates, import and export policies and the fund’s trading direction will bring about great fluctuations to the price of nonferrous metals. Volatility forecasting can help investors make decisions for portfolio allocation and value at risk management for financial traders. Hence, it is of great importance to improve volatility modeling and forecasting in nonferrous metals futures market.

Although the volatility forecasting in stock and energy markets attracts considerable attention of the empirical and theoretical research, relatively little is considered in base (or industrial) metals commodities. The study of metal price is considerably limited and there exist only 45 refereed publications over the period from 1980 to 2002 [1]. In the recent years, the literatures about metals commodities mainly focus on several aspects: volatility properties [2-5], the spillover effect for different markets [6-11] and the information flows between precious metals futures markets [12,13]]; [. Besides, some researchers are trying to analyze the behavioral influences in nonferrous metal prices [14], the impact of speculation [15-17], the price-volume correlation [18] and the role of outliers and oil price shocks on volatility of metal prices [19,20].

As we all know, the impetuous development of Chinese economy triggers high dynamics in the nonferrous metals futures market, which in turn makes the understanding of the time-varying volatility of realized volatility an increasingly important issue. However, none of the above mentioned issues is concerned with the time-varying volatility of realized volatility other than TODOROVA [4]. In addition, most researches discussed above do not consider the leverage effects of nonferrous metals futures market, which are very important for policy makers and investors. The time-varying volatility of realized volatility and leverage effects in nonferrous metals futures market will be our focus in this work.

Several contributions are made to the existing literature. Firstly, in contrast to energy and precious metals commodities, volatility forecasting in nonferrous metals futures market is less studied, while nonferrous metals commodities play a very significant role in national economies. Secondly, in contrast to the LHAR-CJ model proposed by CORSI and RENO [21], we go one step further and account for the conditional heteroscedasticity of residual and volatility clustering by incorporating a GARCH specification. The idea is similar to the work of CORSI et al [22]] [ and ANDERSEN et al [23]. Finally, the sample covers the period from July 1, 2010 to July 1, 2015 and hence may be more significant in volatility forecasting in the light of most recent nonferrous metals futures market history.

2 Volatility estimation and jump detection test statistics

2.1 Volatility estimation

Realized volatility (RV), proposed by ANDERSEN and BOLLERSLEV [24], is an estimation of volatility based on intraday data. It is defined as the sum of squares of daily return. A trading day is divided into M time periods, and then the discrete-time within-day geometric return can be written as

(j=1, 2, 3, …, M)

(j=1, 2, 3, …, M)

where pt,j/M is the jth closing price of the trading day t, M refers to the number of intraday equally return observations over the trading day, which depends on the sampling frequency.

Considering the effect of overnight return on realized volatility, the squared overnight return is added to the realized volatility to forecast the course of daily volatility in Chinese nonferrous metals futures market like BLAIR et al [25] and GONG et al [26]. Therefore, the RV of trading day t (RVt) in this paper can be given as

where  is the squared overnight return, which reflects the overnight logarithmic price change from day t-1 to day t.

is the squared overnight return, which reflects the overnight logarithmic price change from day t-1 to day t.

2.2 Jump detection test statistics

According to the conclusions of BARNDORFF- NIELSEN and SHEPHARD [27,28]] [, the price volatility of financial asset is not continuous due to the influence of information shock on the market and the investors’ behavior. In order to separate the continuous variation and jump variation in RV, the realized bipower variation method and jump test statistics are used. The realized bipower variation (RBV) which is the consistent estimator of integrated volatility, is defined as

(3)

(3)

where  is the excepted absolute value of a standard normal random variable and

is the excepted absolute value of a standard normal random variable and  is the amendment to sample capacity. According to the research of BARNDORFF-NIELSEN and SHEPHARD [27,28], the difference between RVt(M) and RBVt(M) converge in probability to the discontinuous jump variation as the sampling frequency goes to infinity.

is the amendment to sample capacity. According to the research of BARNDORFF-NIELSEN and SHEPHARD [27,28], the difference between RVt(M) and RBVt(M) converge in probability to the discontinuous jump variation as the sampling frequency goes to infinity.

(4)

(4)

In order to select statistically significant jumps from the discontinuous jump variation, the jump test statistics Zt, proposed by HUANG and TAUCHEN [29], is adopted. The expression of test statistics Zt is defined by

(5)

(5)

where RQVt is an estimator of forth-power variation, which is defined by

(6)

(6)

According to ANDERSEN et al [30], RBVt is not a robust estimator to test the discontinuous jump variation since it is greatly influenced by sampling frequency. Due to the impact of factors like microstructure noise of the market, the estimate value of RBVt cannot even converge to integrated volatility with the increase of sampling frequency. ANDERSEN et al [30] proposed MedRVt as the robust estimator instead of RBVt. MedRVt is defined as

(7)

(7)

Accordingly, RQVt of the jump test statistics Zt is also amended by MedRTQt, which was proposed by ANDERSEN et al [30] and can be defined as

(8)

(8)

By replacing RBVt and RQVt with MedRVt and MedRTVQt respectively in jump test statistics Zt, the jump variation component of daily volatility can be given as

(9)

(9)

where I(·) is an indicative function, Φα means the corresponding trigger value at the significance level of α in standard normal distribution. According to previous researches, α=0.99 is adopted. Correspondingly, the continuous variation can be written as

(10)

(10)

3 Data and summary statistics

3.1 Data

Empirical research data used in this paper are from the Shanghai Futures Exchange, China. The sample period covered from July 1, 2010 to July 1, 2015 (1214 d in total) for 3 months copper and aluminum futures, which consists of (1 min) frequency and daily price data. The transaction prices are obtained from CSMAR (http://www.gtarsc.com/). Within the sample interval, the Shanghai Futures Exchange trading hours are from 8:59 a.m. to 11:29 a.m., and from 13:30 p.m. to 15:00 p.m., which has 227 min in total every day, resulting in M=227 in this work.

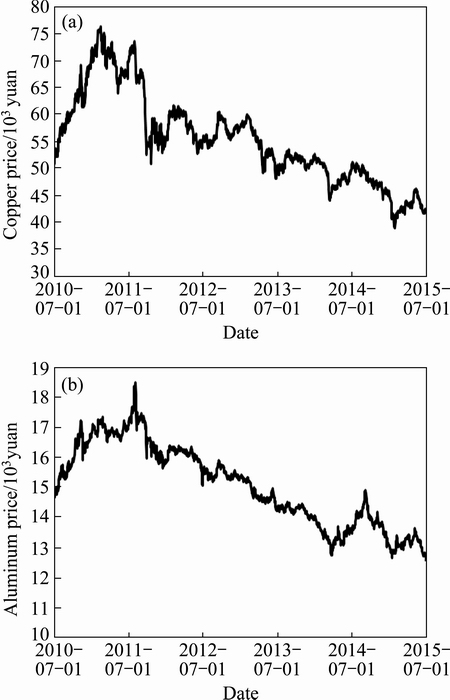

Figure 1 shows the price series of copper and aluminum futures in sample period, which clearly illustrates that the price trend of copper futures resembles that of aluminum futures. The price trend plots illustrate that at the beginning of the sample period, the price level exhibits an upward trend, while the price experiences a persistent decline from the second half of 2011, despite occasional modest increase over the sample period. That may be explained by the increase in the metal supply due to unsustainable rapid expansion of metal producer at the beginning, while the demand decreases.

3.2 Summary statistics

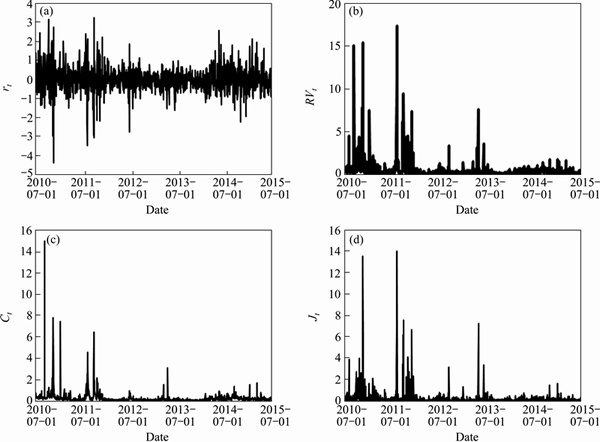

Based on Section 2, the daily return rt, realized volatility RVt and its continuous variation Ct and jump variation Jt are calculated. In order to better analyze the characteristics of different components that make up the total daily return variation for copper and aluminum futures markets, Figs. 2 and 3 are plotted. The figures clearly illustrate that for copper or aluminum futures, each component exhibits volatility clustering, which indicates rather distinct dynamic dependence in each of the different components.

Fig. 1 Closing prices of copper (a) and aluminum (b) futures

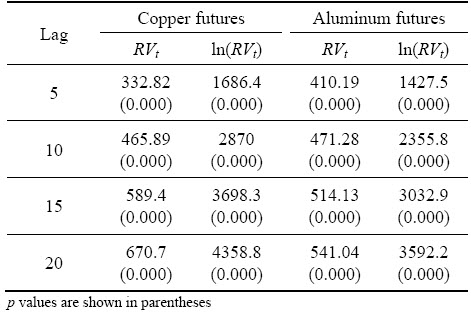

Tables 1 and 2 give the descriptive statistics of daily volatility RVt defined in Eq. (2) and its logarithmic form of copper and aluminum futures, respectively. The sample mean indicates that the volatility of copper is obviously higher than that of aluminum futures. Correspondingly, copper futures prices are more volatile than those of aluminum futures, which is reflected by standard deviations. The standard deviations also reflect time-varying nature. Moreover, daily volatilities for the two metal futures both exhibit positive skewness and excess kurtosis. Ljung-Box Q-statistics of daily realized volatility RVt and daily logarithmic realized volatility ln(RVt) reveal that they all have strong sequence autocorrelation. The comparison of daily volatility and its logarithmic form for skewness and kurtosis also indicates that the distribution of logarithmic form of daily volatility is closer to normal distribution, which is beneficial for statistical purposes. Therefore, the logarithmic form of daily realized volatility in volatility equation is adopted.

Fig. 2 Daily return (a), realized volatility (b) and its continuous (c) and discontinuous jump (d) components of copper futures from July 1, 2010 to July 1, 2015

Fig. 3 Daily return (a), realized volatility (b) and its continuous (c) and discontinuous jump (d) components of aluminum futures from July 1, 2010 to July 1, 2015

Table 1 Descriptive statistical analysis of daily (logarithmic) realized volatility in cooper and aluminum futures

Table 2 Ling-Box Q-statistics of daily (logarithmic) realized volatility in copper and aluminum futures

4 Volatility model

HAR model was proposed by CORSI [31]. Generally, participants in financial market trade at different frequencies. Short-term participants will be easily influenced by both short-term and long-term volatilities, but not vice versa. Hence, the volatility over longer time period has a strong influence on the volatility over short-time period. The HAR model aggregates the volatility over different periods, on daily, weekly and monthly bases to capture the long memory feature. Since it is concise, easy to estimate and well fit long-term memory feature of RVt, this model is widely used by the majority of scholars in research. ANDERSEN et al [32] considered the continuous and jump decomposition of realized volatility separately within a univariate version of the HAR-CJ model. CORSI and RENO [21] went one step further and accounted for the fact that volatility tends to increase more after a negative shock than after a positive shock of the same magnitude, which is the leverage effect. Defining the leverage effect comprising negative shocks over the last day, week and month respectively as =min(rt, 0),

=min(rt, 0),  =min[

=min[ (rt-4+rt-3+…rt), 0],

(rt-4+rt-3+…rt), 0],  =min[

=min[ (rt-21+rt-20+…+rt), 0]. CORSI and RENO [21] incorporated the asymmetry in the original LHAR-CJ model and proposed the new LHAR-CJ model, which is in the following form:

(rt-21+rt-20+…+rt), 0]. CORSI and RENO [21] incorporated the asymmetry in the original LHAR-CJ model and proposed the new LHAR-CJ model, which is in the following form:

(11)

(11)

Similar with the study of ANDERSEN et al[23], the Ljung-Box Q-statistics of the squared and absolute residuals (available upon request) reveal clear evidence for significant conditional heteroskedasticity. Hence, considering the time-varying volatility of volatility, the LHAR-CJ model is augmented by combining a GARCH error structure. Further, allowing for the possibility of fat-tails, the model under the assumption of conditionally t-distribution errors is considered. To keep the model parsimonious, the GARCH(1,1) specification for the conditionally variance of logarithmic realized volatility is used. Hence, the proposed LHAR-CJ-G model can be written as

(12)

(12)

where

.

.

In the original analysis, besides the negative shocks over the last week, the daily and month leverage effects are also included in the equation. However, the corresponding parameters are not significant in copper and aluminum futures markets and are hence omitted.

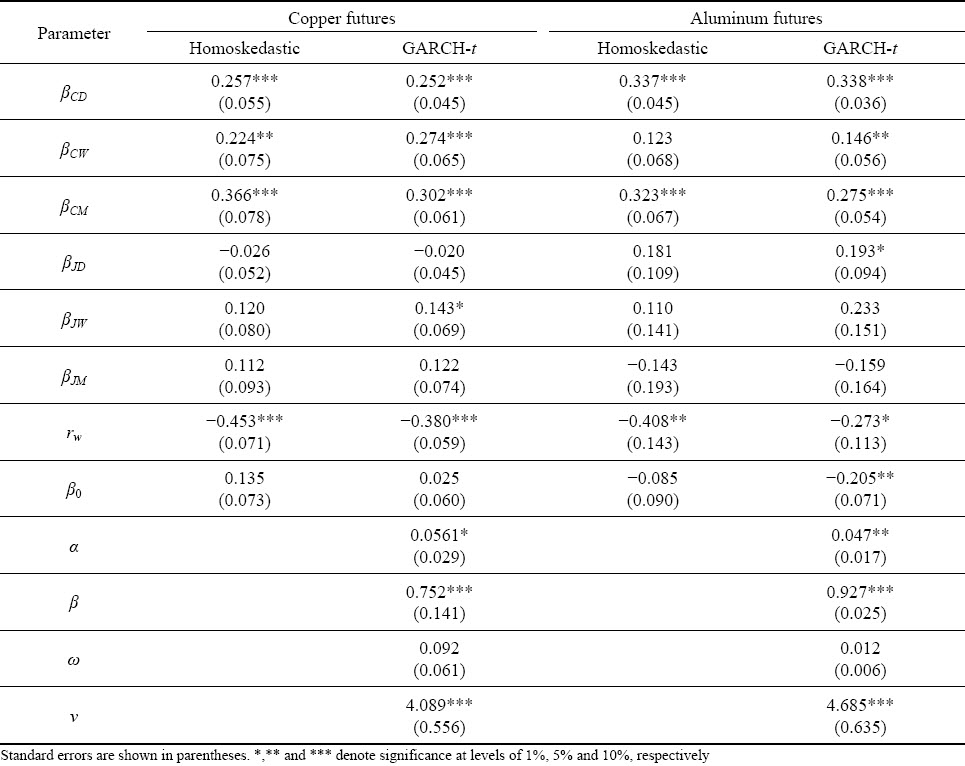

The estimation results of LHAR-CJ model and our LHAR-CJ-G model for copper and aluminum futures price volatilities are shown in Table 3. The left columns in Table 3 report the OLS estimate results and the right columns report the estimate results of incorporating a GARCH specification. As we can see, all of the coefficients of three lagged continuous components are positive and highly significant for copper and aluminum futures, which implies strong heterogeneity in realized volatility and dynamic dependencies. The lagged squared jumps for copper and aluminum futures are generally insignificant in LHAR-CJ model, which is in line with the study of ANDERSEN et al [32] and the S&P 500 futures in ANDERSEN et al [23], while the lagged week and day squared jumps for copper and aluminum futures in LHAR-CJ-G model are significant respectively, which reflects that there exist some evidences of squared jumps in Chinese nonferrous metals futures market. Moreover, for copper futures, the coefficients of one day or one week lagged continuous variation are less than those of one month lagged, which implies that one month lagged continuous variation has greater impact on daily realized volatility. This on one side implies that there is long memory in copper futures market and on the other side illustrates that the daily realized volatility in copper futures market is mainly determined by long-term investors’ trading behavior, which reflects that the Chinese copper futures market may be relatively mature.

Next, the leverage effects are analyzed in Chinese nonferrous metals futures market. The leverage effect refers to that the change trend of returns is negatively related to the change trend of fluctuation. In practical terms, this means that volatility arising from negative returns is greater than that of positive returns. The coefficient of negative return over the last week is significantly negative in both markets, which shows the existence of mid-term leverage effects in Chinese nonferrous metals futures market.

Finally, Table 3 shows that the ARCH and GARCH coefficients (α and β, respectively) are statistically significant. They can capture the clustering of volatility of realized volatility. Moreover, the GARCH coefficients are relatively large and positive, which implies that previous period’s volatility has positive effect on current volatility of realized volatility. This also confirms that there exists volatility clustering of realized volatility in Chinese nonferrous metals futures market.

Table 3 Estimation results from LHAR-CJ and LHAR-CJ-G model

5 Forecasting

Besides gaining a basic understanding of Chinese nonfans metals futures market volatility, volatility forecasting is a potential useful application for hedging, derivative pricing and performance evaluation. The question of calculating one-day-ahead return volatility forecasts Var(rt+1|Ft) is considered. The conditional variance of this framework proposed here can be defined as Var(rt+1|Ft)= E(RVt+1|Ft). As a benchmark comparison, the one-day-ahead forecasts of HAR-RV, HAR-CJ and LHAR-CJ models proposed by CORSI and RENO [21] are also calculated. One-day-ahead forecasts of the four HAR models are compared with the actual realized variation measures (i.e., RVt+1) to assess which model is more accuracy in forecasting daily realized volatility. The first subsection below discusses the full in-sample forecasts and the subsequent section reports the results from the out-of-sample forecasts.

5.1 In-sample forecasts

In order to assess the accuracy of the new LHAR-CJ-G model forecasts, the loss functions are adopted to evaluate the volatility forecasting performance in Chinese nonferrous metals futures market. Loss functions in this work include mean absolute error (MAE) and mean square error (MSE), which are in the following forms:

(13)

(13)

(14)

(14)

where RVt+1 and Vt+1,M denote the actual and one-day-ahead forecasts of daily volatility from model M, respectively. N is the number of sample days observed.

Table 4 shows the MAE and MSE values of one-day-ahead in-sample forecasts for copper and aluminum futures of our LHAR-CJ-G model and other three HAR models based on the data over the full sample period. The corresponding P-values of the Diebold and Mariano test reported in parentheses in Table 4 are shown. The Diebold and Mariano test was proposed to formally test for the statistical significance of the observed differences in the MAE and MSE criteria. The Diebold and Mariano test here is a pairwise comparison of the forecasts from each of the three HAR models to the forecasts from the LHAR-CJ-G model.

From Table 4, it can be inferred that complicated LHAR-CJ-G model holds the lowest in the MAE criteria for copper and aluminum futures. Moreover, the corresponding p-values reported in parentheses in Table 4 are indeed statistically significant. However, for MSE criteria, the lowest in the copper and aluminum futures is the LHAR-CJ model, instead of LHAR-CJ-G model,and the corresponding p-values are slightly statistically significant. Therefore, in summary, the LHAR-CJ-G and LHAR-CJ models present good in-sample forecasting performance among the four models.

Table 4 Results of loss functions and R2 statistic from M-Z regression of in-sample prediction

To further analyze relative performance of the LHAR-CJ-G model, the M-Z regression is also taken into consideration. M-Z regression is widely used to evaluate sample prediction, which is proposed by MINCER and ZARNOWITZ [33]. Its regression equation is

(15)

(15)

where Vt+1,M refers to one-step forecasts at time t from model M. If the model is correctly established, then E[ln(Vt+1,M)]=ln(RVt+1). Therefore, the larger the coefficient of determination R2 is, the better the forecasting performance is. The R2 statistic values from the M-Z regressions are reported in Table 4. The results of M-Z regressions seem to more favor the LHAR-CJ model in both markets. This may be explained by the fact that more estimate parameters lead to parameter uncertainty in the LHAR-CJ-G model than LHAR-CJ model, which may lower the forecast performance due to the innovation of considering the conditional heteroskedasticity of realized volatility.

5.2 Out-of-sample forecasts

Compared with the in-sample forecasts, out-of-sample forecasts may be more significant since they can mimic the real-world forecast situation more closely. In order to better evaluate the out-of-sample forecast performance of the model, the whole sample interval is divided from July 1, 2010 to July 1, 2015 into two parts. The trading data of copper and aluminum futures in Shanghai Futures Exchange from July 1, 2010 to September 31, 2013 are adopted as the estimation sample. On the premise of this, out-of-sample daily volatility from January 1, 2014 to July 1, 2015, which has 364 samples, is forecasted. The method to evaluate the forecast performance of out-of-sample is the same with in-sample performance, that is, using the loss functions and M-Z regression.

Table 5 shows the values of loss functions and R2 statistic from the M-Z regressions for out-of-sample forecasts in copper and aluminum futures. The MAE and MSE criteria achieve their lowest values for the LHAR-CJ-G model whether in copper or aluminum futures and the corresponding p-values reported in parentheses in Table 5 are indeed statistically significant. The results generally favor the LHAR-CJ-G model. As to copper futures, the R2 value from M-Z regressions of LHAR-CJ-G model is the highest, while to aluminum futures, the highest value of R2 is from the HAR-CJ model. But the difference with that of LHAR-CJ-G model is not noticeable. In summary, the complicated LHAR-CJ-G model considering the leverage effects and its time-varying volatility of realized volatility exhibits the best out-of sample forecast performance among the four models.

Table 5 Loss function values and M-Z regressions of out-of-sample prediction

6 Conclusions

1) Chinese nonferrous metals futures market volatility has strong heterogeneity and dynamic dependencies, which implies the long memory in daily realized volatility. Moreover, the volatility clustering is observed in the RV series, which is in accordance with the changing nature of the commodity futures market.

2) There exists significant mid-term leverage effect in realized volatility of Chinese nonferrous metals futures market, which reflects that bad news increases the volatility of Chinese nonferrous metals futures market in mid-term.

3) The daily realized volatility in copper futures market is mainly determined by long-term investors’ trading behavior, while the volatility in aluminum futures market is mainly determined by short and long term investors’ trading behavior, which reflects that the Chinese copper futures market may be relatively mature.

4) Based on the loss function values and M-Z regression results, it can be concluded that the LHAR-CJ-G model, considering time-varying volatility of realized volatility and leverage effects, and LHAR-CJ models both present good in-sample forecast performance among the four models. However, for out-of-sample forecasts, the LHAR-CJ-G model will be more optimal and substantially improves the explanatory power as well as predictive performance.

References

[1] WATKINS C, MCALEER M. Pricing of non-ferrous metals futures on the London metal exchange [J]. Applied Financial Economics, 2006, 16(12): 853-880.

[2] HAMMOUDEH S, YUAN Y. Metal volatility in presence of oil and interest rate shocks [J]. Energy Economics, 2008, 30(2): 606-620.

[3] WATKINS C, MCALEER M. How has volatility in metals markets changed? [J]. Mathematics and Computers in Simulation, 2008, 78(2): 237-249.

[4] TODOROVA N. The course of realized volatility in the LME non-ferrous metal market [J]. Economic Modeling, 2015, 51: 1-12.

[5] PENG Die-feng, WANG Jian-xin, RAO Yu-lei. Applications of nonferrous metal price volatility to prediction of China’s stock market [J]. Transactions of Nonferrous Metals Society of China, 2014, 24(2): 597-604.

[6] LIEN D, YANG L. Intraday return and volatility spill-over across international copper futures markets [J]. International Journal of Managerial Finance, 2009, 5(1): 135-149.

[7] HAMMOUDEH S M, YUAN Y, MCALEER M, THOMPSON M A. Precious metals-exchange rate volatility transmissions and hedging strategies [J]. International Review of Economics & Finance, 2010, 19(4): 633-647.

[8] COCHRAN S J, MANSUR I, ODUSAMI B. Volatility persistence in metal returns: A FIGARCH approach [J]. Journal of Economics and Business, 2012, 64(4): 287-305.

[9] SENSOY A. Dynamic relationship between precious metals [J]. Resources Policy, 2013, 38(4): 504-511.

[10] TODOROVA N, WORTHINGTON A, SOUCEK M. Realized volatility spillovers in the non-ferrous metal futures market [J]. Resources Policy, 2014, 39(39): 21-31.

[11] YUE Yi-ding, LIU Du-chi, XU Shan. Price linkage between Chinese and international nonferrous metals commodity markets based on VAR-DCC-GARCH models [J]. Transactions of Nonferrous Metals Society of China, 2015, 25(3): 1020-1026.

[12] ARUGA K, MANAGI S. Testing the international linkage in the platinum-group metal futures markets [J]. Resources Policy, 2011, 36(4): 339-345.

[13] XU X E, FUNG H G. Cross-market linkages between US and Japanese precious metals futures trading [J]. Journal of International Financial Markets, Institutions and Money, 2005, 15(2): 107-124.

[14] CUMMINS M, DOWLING M, LUCEY B M. Behavioral influences in non-ferrous metals prices [J]. Resources Policy, 2015, 45(12): 9-22.

[15] FASSAS A P. Exchange-traded products investing and precious metal prices [J]. Journal of Derivatives and Hedge Funds, 2012, 18(2): 127-140.

[16] BOSCH D, PRADKHAN E. The impact of speculation on precious metals futures markets [J]. Resources Policy, 2015, 44: 118-134.

[17] SHAO Liu-guo, ZHU Xue-hong, HUANG Jian-bai, LI Hong-sheng. Empirical study of speculation roles in international copper price bubble formation [J]. Transactions of Nonferrous Metals Society of China, 2013, 23(8): 2475-2482.

[18] CHENG Hui, HUANG Jian-bai, GUO Yao-qi, ZHU Xue-hong. Long memory of price–volume correlation in metal futures market based on fractal features [J]. Transactions of Nonferrous Metals Society of China, 2013, 23(10): 3145-3152.

[19] BEHMIR N B, MANERA M. The role of outliers and oil price shocks on volatility of metal prices [J]. Resources Policy, 2015, 46: 139-150.

[20] ZHU Xue-hong, CHEN Jin-ye, ZHONG Mei-rui. Dynamic interacting relationships among international oil prices, macroeconomic variables and precious metal prices [J]. Transactions of Nonferrous Metals Society of China, 2015, 25(2): 669-676.

[21] CORSI F, RENO R. Discrete-time volatility forecasting with persistent leverage effect and the link with continuous-time volatility modeling [J]. Journal of Business and Economic Statistics, 2012, 30(3): 368-380.

[22] CORSI F, MITTNIK S, PIGORSCH C, PIGORSCH U. The volatility of realized volatility [J]. Econometric Reviews, 2008, 27(1-3): 46-78.

[23] ANDERSEN T G, BOLLERSLEV T, HUANG X. A reduced form framework for modeling volatility of speculative prices based on realized variation measures [J]. Journal of Econometrics, 2011, 160(1): 176-189.

[24] ANDERSEN T G, BOLLERSLEV T. Answering the skeptics: Yes, standard volatility models do provide accurate forecasts [J]. International Economic Review, 1998, 39(4): 885-905.

[25] BLAIR B J, POON S H, TAYLOR S J. Forecasting S&P 100 volatility the incremental information content of implied volatilities and high-frequency index retuns [J]. Journal of Econometrics, 2001, 105(1): 5-26.

[26] GONG X, HE Z, LI P, ZHU N. Forecasting return volatility of the CSI 300 index using the stochastic volatility model with continuous volatility and jumps [J]. Discrete Dynamics in Nature and Society, 2014, 2014(3): 1-10.

[27] BARNDORFF-NIELSEN O E, SHEPHARD N. Power and bipower variation with stochastic volatility and jumps [J]. Journal of Financial Econometrics, 2004, 2(1): 1-37.

[28] BARNDORFF-NIELSEN O E, SHEPHARD N. Econometrics of testing for jumps in financial economics using bipower variation [J]. Journal of Financial Econometrics, 2006, 4(1): 1-30.

[29] HUANG X, TAUCHEN G. The relative contribution of jumps to total price variance [J]. Journal of Financial Econometrics, 2005, 3(4): 456-499.

[30] ANDERSEN T G, DOBREV D, SCHAUMBURG E. Jump-robust volatility estimation using nearest neighbor truncation [J]. Journal of Econometrics, 2012, 169(1): 75-93.

[31] CORSI F. A simple approximate long-memory model of realized volatility [J]. Social Science Electronic Publishing, 2009, 7(2): 174-196.

[32] ANDERSEN T G, BOLLERSLEV T, DIEBOLD F X, VEGA C. Real-time price discovery in global stock, bond and foreign exchange markets [J]. Journal of International Economics, 2007, 73(2): 251-277.

[33] MINCER J A, ZARNOWITZ V. The evaluation of economic forecasts [J]. Nber Chapters, 1969: 60(3): 3-46.

朱学红1,2,张宏伟1,钟美瑞1,2

1. 中南大学 商学院,长沙 410083;

2. 中南大学 金属资源战略研究院,长沙 410083

摘 要:运用高频金融数据建模和预测中国有色金属期货市场波动率,并探索已实现波动率的波动时变性和杠杆效应。拓展了LHAR-CJ模型,并对上海期货交易所铜和铝期货进行实证研究。研究表明,已实现波动率存在动态依赖性和时变性,它们均可通过长记忆性的HAR-GARCH结构体现。此外,中国有色金属期货市场波动率存在显著的周杠杆效应。最后,样本内预测和样本外预测的结果表明,考虑了已实现波动率的波动时变性和杠杆效应的HAR-CJ-G模型能有效地提高解释能力和样本外预测能力。

关键词:波动率预测;杠杆效应;波动时变性;有色金属期货;高频数据

(Edited by Wei-ping CHEN)

Foundation item: Project (13&ZD169) supported by the Major Program of the National Social Science Foundation of China; Project (2016zzts009) supported by Doctoral Students Independent Explore Innovation Project of Central South University, China; Project (13YJAZH149) supported by the Social Science Foundation of Ministry of Education of China; Project (2015JJ2182) supported by the Social Science Foundation of Hunan Province, China; Project (71573282) supported by the National Natural Science Foundation of China; Project (15K133) supported by the Educational Commission of Hunan Province of China

Corresponding author: Hong-wei ZHANG; Tel: +86-15084949634; E-mail: hongwei@csu.edu.cn

DOI: 10.1016/S1003-6326(17)60141-9